Your Bank provides Anywhere Branch Banking facility through all its branches. This facility offers following types of transactions for your convenience.

Cash Deposit : Account holder/ business Associates or partners can deposit cash in your Account from any of our branch. This facility is available for Savings, Current, Cash Credit, Recurring Deposit (Installment) and payment of Loan Installment.

Cash Payment : Cash Payment of a bearer/ third party cheques, clearing cheque deposit are allowed from any branch in case of your urgent need of Cash. This facility is available for Savings, Current, Cash Credit. (withdrawal allowed only through cheques)

Balance Enquiry & Passbook/ Statement Printing : You can enquire about your account balance and request for Statement of your account from any branch.

FD Interest credit : Your SB/CA account at any branch will be credited with Interest amount on all deposits in various branches through our Any Branch Banking System and you can get all your FDR interest at one place in one account.

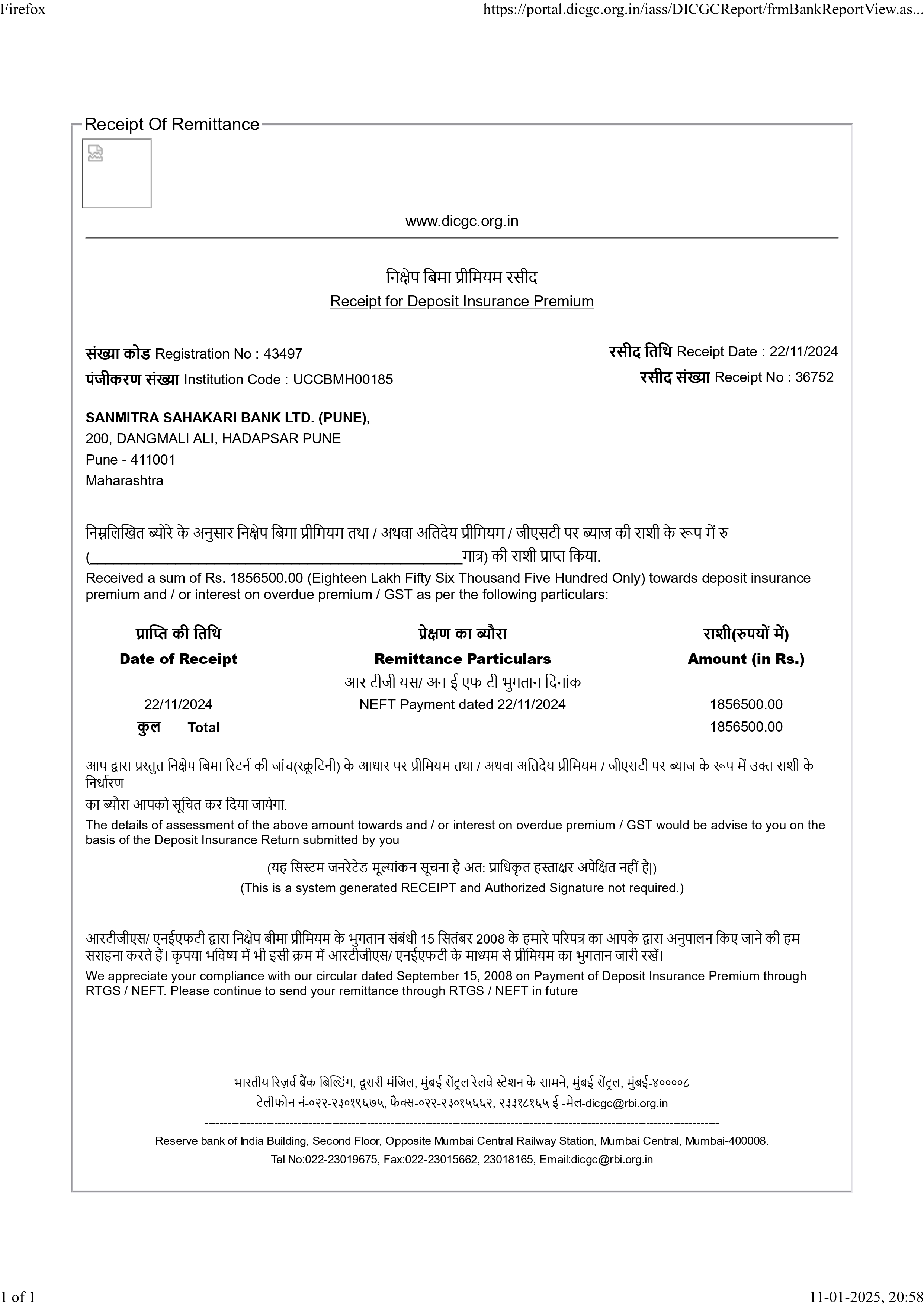

National Electronic Fund Transfer (NEFT) and Real Time Gross Settlement (RTGS) allow individuals, companies and firms to transfer funds from one bank to another. You can check the RBI website for a list of NEFT and RTGS-enabled branches of your bank. These facilities can only be used for transferring money within the country. To opt for these, you need to fill a form providing your or the beneficiary's details-name, bank branch where the account is held, the Indian Financial System Code, a unique code for identifying the branch, and the account number and type. You have to submit a cheque while opting for this facility. You can also transfer funds through net banking. These are third-party transfers and the option is available under the same header on your net banking home page.

Sanmitra Sahakari Bank Ltd., in an attempt to fulfill the ever rising needs of banks customers, has launched SMS banking facility for it's customers.SMS Banking brings Banking to your fingertips.

With SMS, you can perform a wide range of query based transactions from your mobile phone at a very low cost.

SMS Banking Services:-

Check account balances

Recent transactions

Why is PAN required?

A Permanent Account Number (PAN) is a 10-digit alphanumeric number issued on a card officiated by the Income Tax department. PAN card is a critical document for every individual who is a taxpayer. The tax one pays is credited to their account with the Income Tax Department, and the tax that they are liable to pay is also fed in the same account. Hence, at the end of the year, the tax accounts are checked, and the calculated amount of tax is collected from or refunded to the account as per the scenario. All this process is made possible with the help of the PAN card, which acts as the key to access information from the individual's account.

When is PAN required?

Some organizations are required by the Income Tax Department to report certain transactions only with the PAN of the person in charge of the transactions. In such cases, PAN card is a necessity.

It is also used as an identity proof while opening bank accounts, making sale or purchase of valuable assets like property and jewelry, and other similar fairly large transactions.

All economic or financial transactions associated with the Central Board of Direct Taxes need PAN information.

Deposits exceeding INR 50,000 require quoting PAN.

The Safe Deposit Locker facility offers invaluable safety for you valuables We also have on offer a variety of sizes to fit your requirements The deposit lockers can be operated at your convenience during our banking hours. We provide the maximum safety to your valuables that are placed in our Safe Deposit Lockers.

Eligibility to rent a locker:-

Must be an A/c Holder

Minimum Amount to open an A/c : 500/-

The point of sale (POS) or point of purchase (POP) is the time and place where a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice for the customer (which may be a cash register printout), and indicates the options for the customer to make payment. It is also the point at which a customer makes a payment to the merchant in exchange for goods or after provision of a service. After receiving payment, the merchant may issue a receipt for the transaction, which is usually printed but is increasingly being dispensed with or sent electronically.